Grab your pass at only SGD 750 before 31 July 2026

-

70,000+ Participants

- |

-

940+ Speakers

- |

-

600+ Sponsors & Exhibitors

- |

-

300 Sessions

- |

-

142 Countries & Regions

- |

-

840 Central Banks, Regulatory Institutions and Government Organisations

- |

-

20,000+ SFF MeetUp Meetings

- |

-

Welcome to the world's largest FinTech Festival

- |

-

70,000+ Participants

- |

-

940+ Speakers

- |

-

600+ Sponsors & Exhibitors

- |

-

300 Sessions

- |

-

142 Countries & Regions

- |

-

840 Central Banks, Regulatory Institutions and Government Organisations

- |

-

20,000+ SFF MeetUp Meetings

- |

-

Welcome to the world's largest FinTech Festival

- |

Latest Festival Updates

Make the most of your SFF experience with our Self-Discovery Tours.

Designed to help you navigate all 5 exhibition halls with ease, these Self-Discovery Tours highlight key areas of interest across 5 thematic categories. Each trail takes you through a curated route of innovation hotspots, from emerging technologies to game-changing solutions shaping the financial world.

Trace Singapore’s FinTech Blueprint. Play & Win at SFF!

Across eight checkpoints, from Ant International, NETS, UOB, and DBS Bank, to OCBC, Liquid Group, StraitsX and the SFF Gallery, you’ll relive the defining milestones that shaped Singapore’s FinTech journey. Look out for the game QR codes at registration, redemption counters between Halls 5 and 6, the F&B areas, and at all eight checkpoints. Complete quizzes, collect badges, and unlock insights into what the next decade of finance and technology could look like.

.png?width=290&height=185&name=Untitled%20design%20(19).png)

Have Singapore FinTech Festival at your fingertips.

Get ready for SFF 2025! Download the official app now to plan your sessions, network with fellow attendees, and stay updated in real-time. Whether you're attending virtually or in person, this app is your key to a seamless festival experience.

2025 Themes

New Payments Settlement Layer

New Intelligent Financial Systems

New Encryption Architecture

The Visionaries Leading Innovation

-

H.E. Abdul Rasheed Ghaffour

Governor

Central Bank of Malaysia

H.E. Abdul Rasheed Ghaffour

Governor

Shaik Abdul Rasheed Ghaffour is the 10th Governor of Bank Negara Malaysia. He was appointed for a five-year term effective 1 July 2023. In his role as Governor, Rasheed also serves as the chair of the Bank’s Board of Directors, Monetary Policy Committee and Financial Stability Executive Committee.

Rasheed joined the Bank in 1988 and has helmed various positions across the breadth of the Bank’s primary functions. These include monetary policy and economics, international reserves management and financial markets, financial sector development, and banking regulations. In 2016, he assumed the role of Deputy Governor.

Rasheed has also played a leading role in driving the Bank’s advocacy efforts on economic affairs, including in the areas of social protection and labour market reforms. This includes to support and advise the Government on issues relating to the management of the pandemic. He also played key roles in the development and implementation of the Financial Sector Masterplan and Financial Sector Blueprints.

At the international level, Rasheed has served and been a member of various international platforms, such as the Islamic Financial Services Board and Bank for International Settlements. He has also championed various efforts to strengthen regional financial integration and cooperation, such as the ASEAN Banking Integration Framework. Previously, he also served as the Alternate Executive Director of the Southeast Asia Voting Group Office of the International Monetary Fund.

Rasheed attended St. John’s Institution in Kuala Lumpur, prior to obtaining his Bachelor of Economics from Universiti Malaya. Rasheed also holds a Masters of Business Administration from Saïd Business School, University of Oxford. -

Agustín Carstens

Former General Manager

Bank for International Settlements (BIS)

Agustín Carstens

Former General Manager

Agustín Carstens served as General Manager of the BIS from 1 December 2017 to 30 June 2025. Under his tenure, the BIS Innovation Hub was created.

Mr Carstens was Governor of the Bank of Mexico from 2010 to 2017. A member of the BIS Board from 2011 to 2017, he was chair of the Global Economy Meeting and the Economic Consultative Council from 2013 until 2017. He also chaired the International Monetary and Financial Committee, the IMF's policy advisory committee from 2015 to 2017.

Mr Carstens began his career in 1980 at the Bank of Mexico. From 1999 to 2000, he was Executive Director at the IMF. He later served as Mexico’s deputy finance minister (2000–03) and as Deputy Managing Director at the IMF (2003–06). He was Mexico's finance minister from 2006 to 2009.Mr Carstens was member of the Financial Stability Board from 2010 to 2025 .

Mr Carstens is a member of the Group of Thirty and recently joined the GFTN International Advisory Board.

Mr Carstens holds an MA and a PhD in economics from the University of Chicago. -

Amitabh Kant

Former G20 Sherpa

India

Amitabh Kant

Former G20 Sherpa

Amitabh Kant is a governance reformer and a public policy change agent. He was recently G20 Sherpa to the Prime Minister of India. As India's Sherpa to the G20 during India's Presidency of G20 in 2022-23, he navigated the challenging geopolitical waters, steering the G20 towards a consensus on a decisive and action-oriented New Delhi Leaders' Declaration, an essential document that outlined a clear path for addressing pressing global issues.

Beyond his G20 role, Amitabh Kant's illustrious career spans key senior positions in the Government of India, where he spearheaded initiatives that reshaped the nation's economic landscape. His journey in public service includes serving as the Chief Executive Officer (CEO) of National Institution for Transforming India (NITI Aayog) with Prime Minister of India as its Chairman. His tenure also saw him at the helm of the Department for Industrial Policy and Promotion (DIPP) in India and CEO of the Delhi-Mumbai Industrial Corridor Development Corporation (DMICDC) and Secretary, Tourism Government of Kerala. In these capacities, he demonstrated an unwavering commitment to pursuing reforms, driving economic growth and innovation in India.

Amitabh Kant is a true thought leader and has been a driving force behind numerous reforms and initiatives that have revolutionized India's landscape. Initiatives like Startup India, Make in India, Incredible India, Ease of Doing Business reforms and the Aspirational Districts Program and Production Linked Incentive (PLI) have left an indelible mark on the nation. His books, including "Made in India," "Incredible India 2.0," and "Branding India - An Incredible Story," have helped shape India's narrative. He has edited The Path Ahead: Transformative Ideas for India.

Beyond India's borders, Amitabh Kant has been a member of the Steering Board of the "Shaping the Future of Production Systems" initiative at the World Economic Forum (WEF). He's also a Champion of the EDISON Alliance of the WEF, which focuses on deepening digital inclusion in areas such as health, education, and finance for developing nations worldwide. His contributions extended to the Management Board of the International Transport Forum (ITF), a unique inter-governmental agency for global transport.

He received the prestigious Sir Edmund Hillary Fellowship, conferred by the Prime Minister of New Zealand, is a Chevening Scholar and recipient of One Globe Award for leadership in Transforming Governance for the 21st Century. In the dynamic and ever-changing realm of global governance, Amitabh Kant stands as an unwavering beacon of leadership, innovation, and transformative change, not only for India but for the world. His journey is a testament to the power of visionary leadership and public policy in shaping the future of nations and the global community. -

Andréa M Maechler

Deputy General Manager

Bank for International Settlements (BIS)

Andréa M Maechler

Deputy General Manager

Andréa M Maechler became Deputy General Manager of the BIS on 1 September 2023.

Ms Maechler was a member of the Governing Board of the Swiss National Bank (SNB) from 2015 until 2023. At the SNB, she was responsible for the Money Market and Foreign Exchange, Asset Management, Banking Operations and Information Technology portfolios.

Prior to joining the SNB, she was Deputy Division Chief in the Global Markets Analysis Division of the International Monetary Fund. She has worked at other international organisations, including the European Systemic Risk Board and the Organisation for Economic Co-operation and Development.

She was Chair of the Global Foreign Exchange Committee of central banks from December 2021 to June 2023. Ms Maechler has a PhD and a master's degree in International Economics from the University of California, Santa Cruz, and a Diploma of Higher Studies (DES) in International Relations from the Graduate Institute of International Studies in Geneva, Switzerland. -

Dr. Axel Weber

International Advisory Board Member, Global Finance & Technology Network (GFTN) & President, Center for Financial Studies

Global Finance & Technology Network (GFTN)

Dr. Axel Weber

International Advisory Board Member, Global Finance & Technology Network (GFTN) & President, Center for Financial Studies

Prof. Dr. Axel A. Weber is President of the Center for Financial Studies, Goethe University Frankfurt. He is the Chairman of the Board of Directors of RAISIN SE, Chairman of the VISA Economic Empowerment Institute, Chairman of the Trilateral Commission Europe and a Member of the Group of Thirty. He also is a Member of the TEMASEK International Advisory Council and Senior Advisor to CVC Advisors Limited and Boston Consulting Group. He previously was Chairman of the Board of Directors of UBS Group AG.

From 2004 to 2011 Weber was President of the Deutsche Bundesbank and a member of the governing council of the European Central Bank. In recent years he has also acted as a member of the steering committee of the European Systemic Risk Board and as a member of the steering committee of the Financial Stability Board. Dr. Weber served as German Governor at the International Monetary Fund. He was a member of the German Council of Economic Experts (2002-2004), of the expert advisory panel to the Deutsche Bundesbank, of the Board of Directors of the Bank for International Settlements, of the G7 and the G20 Ministers and Governors, and a member on the Grant Commissioning Panel of the Economic and Social Science Research Council of the United Kingdom. -

Dr. Chang Yong Rhee

Governor

Bank of Korea

Dr. Chang Yong Rhee

Governor

Chang Yong Rhee has been the Governor of the Bank of Korea and Chairman of its Monetary Policy Board since 2022. He currently serves as Chair of the Committee on the Global Financial System and as a member of the Board of Directors at the Bank for International Settlements.

Between 2014 and 2022, he served as the Director of the Asia and Pacific Department at the International Monetary Fund. Prior to that, he was Chief Economist of the Asian Development Bank from 2011 to 2014, Secretary General and Sherpa of the Presidential Committee for the 2010 G-20 Seoul Summit from 2009 to 2011, and Vice Chairman of the Financial Services Commission from 2008 to 2009.

Earlier in his career, Mr. Rhee was a Professor of Economics at Seoul National University and an Assistant Professor at the University of Rochester. He holds a Ph.D. in Economics from Harvard University.

In 2011, he was awarded the Order of Civil Merit (Peony Medal) by the Government of the Republic of Korea. -

H.E. Dr. Chea Serey

Governor

National Bank of Cambodia

H.E. Dr. Chea Serey

Governor

Serey Chea is the Governor of National Bank of Cambodia. She is passionate about financial inclusion and women economic empowerment. Achievements under her leadership include the establishment of Credit Bureau Cambodia in 2012 that propelled Cambodia’s Ease of Access to Finance to number 7 worldwide in 2017 by the World Bank, the introduction of Bakong, a national backbone payment system using DLT allowing interoperability amongst all financial service providers making financial services more accessible and affordable, and the introduction of financial literacy into the general education program. Serey holds a PhD in economics and was internationally recognized as a Level A- Central Bank Governor by Global Finance in 2024 and 2025 for her leadership.

-

Chia Der Jiun

Managing Director

Monetary Authority of Singapore

Chia Der Jiun

Managing Director

Mr Chia Der Jiun was appointed Managing Director of the Monetary Authority of Singapore (MAS) on 1 January 2024. He was previously Permanent Secretary (Development) at the Ministry of Manpower (MOM). Prior to his appointment at MOM in 2020, Der Jiun had spent 18 years at MAS in a range of functions covering monetary policy implementation, reserve management, macroeconomic surveillance, and banking supervision and regulation. At the MAS, he was last Deputy Managing Director (Corporate Development) with responsibilities for risk, finance, payment system and currency operations, HR and organisation transformation. Der Jiun also served as Executive Director for Southeast Asia at the International Monetary Fund from 2011 to 2013. He holds a BA(Hons) in Politics and Economics from Oxford University and an MBA from INSEAD.

-

Eric Jing

Chairman

Ant Group

Eric Jing

Chairman

Mr. Eric Jing serves as the Chairman of Ant Group, having initially joined Alibaba Group in 2007, he held the position of the Chief Executive Officer at Ant Group from October 2016 to December 2019, and subsequently from March 2021 to February 2025. Mr. Jing has been serving as the Chairman of Ant Group since April 2018.

Under Mr. Jing's leadership, Ant Group has evolved from a mobile payment pioneer to a globally recognized open platform for digitalization, through continuous technological innovation in a comprehensive collaborative ecosystem. Currently, the company is advancing Al-driven inclusive digital financial services, digital healthcare services, and other digital technology offerings for billions of consumers and small businesses worldwide.

Mr Jing serves as a board member at the World Economic Forum's Young Global Leaders Foundation and a Patron of Nature at the International Union for Conservation of Nature (IUCN). He also held high-level advisory roles at various prominent international institutions, including the International Monetary Fund (IMF) and IJN Secretary-General's Digital Financing Taskforce.

Mr. Jing completed his Bachelor's degree in Engineering from the College of Economics & Management, Shanghai Jiao Tong University in 1994. He subsequently earned his Master's degree in Business Administration from the Carlson School of Management, University of Minnesota, U.S. in 2005. -

Forest Lin

Corporate Vice President, Head of Tencent Financial Technology

Tencent

Forest Lin

Corporate Vice President, Head of Tencent Financial Technology

Mr. Lin oversees Tencent’s overall fintech business, including payment, wealth management, securities and other fintech services. Previously he was the Managing Partner at Tencent Investment, where he was responsible for Tencent’s equity investment in various areas, such as e-commerce, Internet Finance, Online to Offline and digital content etc. Notable deals include JD.com, China Literature, Tencent Music, Meituan, PDD, Bilibili etc. Prior to joining Tencent, Mr. Lin held various senior positions in finance, strategy, and operating management at Microsoft and Nokia. Forest Lin holds an MBA from the Wharton School of the University of Pennsylvania and a Bachelor of Engineering from Zhejiang University.

-

Gan Kim Yong

Deputy Prime Minister and Minister for Trade and Industry, Republic of Singapore, and Chairman of the Monetary Authority of Singapore

Republic of Singapore

Gan Kim Yong

Deputy Prime Minister and Minister for Trade and Industry, Republic of Singapore, and Chairman of the Monetary Authority of Singapore

Mr Gan Kim Yong is the Deputy Prime Minister and Minister for Trade and Industry. He is also the Chairman of the Monetary Authority of Singapore, and is responsible for the Strategy Group in the Prime Minister’s Office. In addition, Mr Gan is a member of the Research, Innovation and Enterprise Council and the National Research Foundation Board.

Mr Gan entered politics in 2001 and is a Member of Parliament (MP) for Punggol GRC. He has held positions in the Ministry of Education, Ministry of Manpower and Ministry of Health. He also helmed the Ministerial Committee on Ageing, to drive the formulation and implementation of ageing policies in Singapore, and co-chaired the Multi-Ministry Taskforce on COVID-19 from 2020 to 2023, which directed and coordinated Singapore’s response to the COVID-19 pandemic.

Mr Gan started his career in the Singapore Civil Service at the Ministry of Trade and Industry and the Ministry of Home Affairs. In 1989, he left the civil service for the private sector and joined NatSteel Ltd as a manager for Corporate Planning. He was promoted to Executive Vice President of NatSteel and CEO of NatSteel Resorts International and NatSteel Properties in 1996. In 2005, he became the CEO and President of NatSteel.

Mr Gan was awarded the Overseas Merit Scholarship to read Engineering in Cambridge University and graduated with a bachelor’s degree (honours) in 1981. Mr Gan subsequently obtained his master’s degree in Engineering from Cambridge University in 1985.

Born in 1959, Mr Gan is married with two daughters. -

George Lee

Co-head

Goldman Sachs Global Institute

George Lee

Co-head

George Lee is the co-head of the Goldman Sachs Global Institute. He joined Goldman Sachs in 1994 and was named a Partner of the Firm in 2004. George formerly served as co-head and Chairman of the Technology, Media and Telecom (TMT) group in Investment Banking as co-Chief Information Officer (CIO) of Goldman Sachs and as a member of the Firm’s Management Committee. During his career, George has advised many of the Firm’s most important clients, including Microsoft, Apple, Alphabet, Meta, Tesla, Adobe, Baidu, eBay, Atlassian, Uber, Dropbox and Cloudflare, In his role as co-CIO, George helped to set technology strategy and policy for the Firm and managed a global workforce of engineers. In his current role, George is advancing the Firm’s thought leadership at the intersection of geopolitics, advanced technology and markets – publishing white papers, hosting conferences and advising clients. He also co-leads the Firm’s artificial intelligence (AI) steering group.

-

Javier Pérez-Tasso

Chief Executive Officer

Swift

Javier Pérez-Tasso

Chief Executive Officer

Javier Pérez-Tasso was appointed Chief Executive Officer at Swift in July 2019. In this position, he has led the company’s new strategy for instant and frictionless payments and securities processing. Prior to this role, he was Chief Executive, Americas & UK region since September 2015. In this position, he significantly deepened Swift’s engagement model with global transaction banks and successfully delivered business development results in high-growth markets.

He was also an Executive sponsor of Swift’s Customer Security Programme from 2016 to 2018, helping to formulate and lead Swift’s response to the growing cyber challenge facing the community. Javier joined Swift in 1995 and held a number of positions, including Chief Marketing Officer. Earlier in his career, he held a number of technology and leadership positions in business development in regional offices in Europe, the Middle East and Africa. -

Jessica Rusu

Chief Data, Information & Intelligence Officer

Financial Conduct Authority (FCA)

Jessica Rusu

Chief Data, Information & Intelligence Officer

Jessica joined the FCA as Chief Data, Information and Intelligence Officer in June 2021.

As CDIIO, Jessica is leading the transformation of the FCA’s ability to analyse and use the data, intelligence and information it receives to effectively oversee the 50,000 firms it regulates. Jessica is building and evolving the FCA's relationship with big tech companies, fintechs and the wider data science community.

Jessica was the Chief Data Officer of Chetwood Financial limited, a digital native, start-up bank, where she spearheaded the use of machine learning. Before moving into fintech, Jessica was Senior Director of Finance & Analytics at eBay in Europe where she built out their advanced analytics and customer insight function.

She previously worked in credit analytics at Ford Motor Company and Stress Testing at GE Capital. Jessica has a degree from Penn State University in Management Science and Information Systems and an MBA from University of Michigan. More recently, she completed the Oxford Said Business School’s Artificial Intelligence programme. -

José Luis Escrivá

Governor

Banco de España (Bank of Spain)

José Luis Escrivá

Governor

José Luis Escrivá is Governor of the Banco de España and member of the Governing Council and the General Council of the ECB. He is Chair of the Board of Governors of CEMLA. He is member of various European and International Committees, including the ESRB, the FSB and the BIS Group of Governors and Heads of Supervision. He is also Vice-Chair of the Board of the Spanish Macroprudential Authority (AMCESFI).

Prior to his current position he was the Spanish Minister for Digital Transformation and Civil Service (2023-2024) and the Spanish Minister for Inclusion, Social Security and Migration (2020-2023). He was the first President of Spain’s Independent Authority for Fiscal Responsibility (AIReF) from 2014 to 2020 and also served as Chair of the EU Network of Independent Fiscal Institutions (2015-2019).

He began his career at the Banco de España, where he held different responsibilities in the Economic and Research General Directorate. He actively participated in the process of monetary integration. Since 1993, he was an adviser to the European Monetary Institute and with the start of the Monetary Union, he was appointed Head of the Monetary Policy Division of the ECB in 2000.

He worked at the BBVA Group from 2004 to 2012, first as its global Chief Economist and Director of the Research Department, and from 2010 as General Director responsible for Public Finance.

From 2012 to 2014, he served as the Chief Representative for the BIS Americas Office.

He holds a degree in Economics, with honours, from the Complutense University in Madrid and completed post-graduate studies in economic analysis at the same university and in econometrics at the Banco de España Training Centre. -

Kattiya Indaravijaya

Chief Executive Officer

KASIKORNBANK

Kattiya Indaravijaya

Chief Executive Officer

Kattiya Indaravijaya is the first non-family and one of the first female CEOs among top-tier banks in Southeast Asia. She began her career at KASIKORNBANK PCL (KBank) in 1987, later earned a KBank scholarship, and returned to continue serving the Bank ever since. Over more than three decades, she has accumulated diverse experience across corporate strategy, digital transformation, investment banking, retail banking, finance, marketing, and human resources.

Appointed CEO in 2020, she has led KBank through periods of economic uncertainty, including the COVID-19 crisis and rapid industry disruption, by harnessing advanced technology, AI, and human potential to achieve sustainable growth. Guided by KBank’s vision as a Bank of Sustainability, KBank strives to drive sustainable prosperity by elevating and unleashing the full potential of every life and business across Thailand and ASEAN+3 through trusted, innovative financial solutions

Under her leadership, KBank has solidified its No.1 position in Thailand in digital payments, mobile banking, and wealth management, while earning widespread domestic and global recognition. In 2024, she was recognized as one of the Top 30 in Fortune’s Most Powerful Women Asia, underscoring her influence in shaping the future of banking in the region. -

H.E. Khalid Humaidan

Governor

Central Bank of Bahrain

H.E. Khalid Humaidan

Governor

His Excellency Khalid Humaidan was appointed as Governor of the Central Bank of Bahrain (CBB) in February 2024.

Prior to his appointment as Governor, HE Mr. Humaidan served as Chief Executive of the Bahrain Economic Development Board (EDB), and Head of Global Markets MEA at BNP Paribas.

He has over 25 years of experience working in financial and capital markets, and currently serves as member on the boards of the Bahrain Economic Development Board (EDB), the Central Bank of Bahrain (CBB), Gulf Payments and the Gulf Monetary Council.

HE Mr. Humaidan holds a Bachelor of Science in Finance from Lehigh University in Pennsylvania, United States. -

Kristo Käärmann

Chief Executive Officer

Wise

Kristo Käärmann

Chief Executive Officer

Kristo Käärmann is the co-founder and CEO of Wise.

Wise is a global technology company, building the best way to move and manage the world’s money. With the Wise account people and businesses can hold over 40 currencies, move money between countries and spend money abroad. Large companies and banks use Wise technology too; an entirely new cross-border payments network that will one day power money without borders for everyone, everywhere. However you use the platform, Wise is on a mission to make your life easier and save you money.

Wise launched in 2011 under its original name, TransferWise. In fiscal year 2025, Wise served over 15.6 million people and businesses, processing approximately £145.2 billion in cross-border transactions, saving customers around £2 billion in fees. It is one of the world’s fastest growing, profitable technology companies and is listed on the London Stock Exchange under the ticker, WISE.

Prior to starting Wise, Kristo was a management consultant with Deloitte Consulting and PricewaterhouseCoopers. He worked with European banks and insurers to modernise their processes and systems. Stunned by their inefficiency, he teamed up with Taavet Hinrikus, then Skype's director of strategy, to develop an entirely new system for moving money across borders. Kristo was selected as one of the World Economic Forum’s Technology Pioneers 2015. -

Leong Sing Chiong

Deputy Managing Director, Markets and Development

Monetary Authority of Singapore

Leong Sing Chiong

Deputy Managing Director, Markets and Development

Mr Leong Sing Chiong was appointed as Deputy Managing Director for Markets and Development on 1 February 2021. He oversees the Markets & Investment, Development & International, FinTech & Innovation, as well as Sustainability Groups. Prior to this, Mr Leong served as Assistant Managing Director overseeing the Monetary & Domestic Markets Management Department and the Reserves Management Department since June 2018. He also served as Assistant Managing Director of the Development and International Group from 2013-2018.

Mr Leong began his MAS career with the Reserves Management Department in 1993 and served as Staff Assistant to the Managing Director from 1997-1998. In 1999, he joined the Monetary Management Division and was responsible for the implementation of MAS’ monetary policy and money market operations. Thereafter, Mr Leong was appointed Chief Representative of MAS’ London Representative Office from 2002-2004. Mr Leong spent six years with the International Department from 2004-2010 and was appointed as the Executive Director of Financial Centre Development Department from 2010-2013.

Mr Leong is a recipient of the Public Administration Medal (Silver). He holds a B.Sc Economics (Monetary Economics) from the London School of Economics and is married with two children. -

Prof. Marlene Amstad

Chair of Board of Directors

Swiss Financial Market Supervisory Authority (FINMA)

Prof. Marlene Amstad

Chair of Board of Directors

Marlene Amstad serves as Chair of the Swiss Financial Market Supervisory Authority (FINMA) and as a board member of the International Organization of Securities Commissions (IOSCO). She brings over 30 years of experience in central banking and financial supervision and has specialised in international financial markets and financial technology. Her previous roles include positions at the Swiss National Bank, the Bank for International Settlements (BIS), and the Federal Reserve Bank of New York.

She spent nearly a decade in Asia, where she coordinated the Asian Bond Fund (ABF) initiative at the BIS in Hong Kong and served as advisor to more than ten Asian central banks. As Co-Director of the FinTech Center at the Shenzhen Finance Institute (SFI), she focused on the intersection of finance and emerging technologies. She is co-editor and co-author of the book CBDC and FinTech in Asia.

Marlene Amstad is an Honorary Professor at the University of Bern and a Senior Fellow at Harvard University. -

Michael S. Barr

Governor

Federal Reserve

Michael S. Barr

Governor

Michael S. Barr took office as a member of the Board of Governors of the Federal Reserve System on July 19, 2022, for an unexpired term ending January 31, 2032. Mr. Barr served as the Vice Chair for Supervision of the Board of Governors of the Federal Reserve System from July 19, 2022, to February 28, 2025.

Prior to his appointment to the Board, Mr. Barr was the Joan and Sanford Weill Dean of the Gerald R. Ford School of Public Policy, the Frank Murphy Collegiate Professor of Public Policy, the Roy F. and Jean Humphrey Proffitt Professor of Law at the University of Michigan Law School, and the founder and faculty director of the University of Michigan's Center on Finance, Law & Policy. At the University of Michigan Law School, Mr. Barr taught financial regulation and international finance and co-founded the International Transactions Clinic and the Detroit Neighborhood Entrepreneurs Project.

Mr. Barr served as the U.S. Department of the Treasury's assistant secretary for financial institutions, 2009-2010. Under President William J. Clinton, he served as the Treasury Secretary's special assistant, as deputy assistant secretary of the Treasury, as special adviser to the President, and as a special adviser and counselor on the policy planning staff at the U.S. Department of State.

Additionally, Mr. Barr served as a law clerk to U.S. Supreme Court Justice David H. Souter during October Term 1993, and previously to the Honorable Pierre N. Leval, then of the Southern District of New York.

Mr. Barr received a BA in history from Yale University, an MPhil in international relations from Oxford University, and a JD from Yale Law School. -

Mohamed Abdelbary

Group Chief Executive Officer

Abu Dhabi Islamic Bank (ADIB)

Mohamed Abdelbary

Group Chief Executive Officer

Mohamed Abdelbary, CFA – Group CEO, Abu Dhabi Islamic Bank (ADIB)

Mohamed Abdelbary is the Group Chief Executive Officer of ADIB, one of the world’s leading Islamic banks. He is a distinguished leader in the banking sector, recognized for his extensive expertise and significant contributions to the industry. With over 28 years of experience in financial services and banking, he has held key positions in leading financial institutions, including Citibank, Barclays Bank, and Standard Chartered Bank. His deep knowledge and strategic vision have been instrumental in driving the growth and success of the organizations he has been part of.

Abdelbary joined ADIB in May 2020 as the Group Chief Financial Officer, a role in which he played a pivotal role in shaping the financial strategy and performance of the bank. His leadership has been marked by a consistent pursuit of operational excellence, revenue growth and cost optimization, positioning ADIB as a leader in the Islamic banking landscape.

Under Mohamed’s leadership, ADIB continues to uphold its commitment to Sharia-compliant principles while embracing digital innovation to enhance customer experiences. His leadership has been instrumental in ADIB’s remarkable performance, reflected in the bank’s robust financial health and market position. With total assets worth approximately AED270 billion, ADIB remains one of the leading Islamic banks in the UAE, serving over 2 million customers. Mohamed’s vision and strategic acumen have been key drivers in the bank’s continued growth and success.

Beyond his professional achievements, Mohamed is a committed advocate for financial inclusion and sustainability. His efforts to promote sustainable finance initiatives, including the issuance of green Sukuk and support for socially responsible projects, highlight his dedication to driving positive social and environmental impact.

Mohamed possesses the CFA® Charter holder credential, demonstrating his commitment to the highest standards of ethics and professionalism in the industry. As a leader, he embodies the values of integrity, accountability, and innovation. His visionary leadership and unwavering commitment to excellence continue to shape ADIB’s path towards a future of sustainable growth and prosperity. -

Monica Long

President

Ripple

Monica Long

President

Monica Long is the President of Ripple where she leads the company’s Business, Product and Engineering teams, collectively working to make Ripple the one-stop shop to move, manage, hold and tokenize value. Since joining Ripple in 2013 as its first marketing and communications hire, Monica has played a pivotal role in shaping the company’s growth and driving innovation in financial services.

Monica serves as Executive Sponsor of the Women at Ripple Employee Resource Group. Recognized among the Bay Area’s Most Influential Women in Business in 2020, Monica has spent her career at the forefront of fintech, previously holding roles at Intuit and managing PR for groundbreaking startups like Prosper. She holds a BA from UC Berkeley. -

Nandan Nilekani

Co-founder & Chairman of the Board

Infosys

Nandan Nilekani

Co-founder & Chairman of the Board

Nandan Nilekani is the Co-Founder and Chairman of Infosys Technologies Limited. He was the Founding Chairman of the Unique Identification Authority of India (UIDAI) in the rank of a Cabinet Minister from 2009- 2014. Nandan has co-founded and is the Chairman of EkStep Foundation, a not-for-profit effort to create a learner centric, technology based platform to improve basic literacy and numeracy for millions of children. In Jan 2023, he was appointed as the co- chair of the “ G20 Task Force on Digital Public Infrastructure for Economic Transformation, Financial Inclusion and Development”.

Born in Bengaluru, Nilekani received his Bachelor’s degree from IIT, Bombay. Fortune Magazine conferred him with “Asia’s Businessman of the year 2003”. In 2005 he received the prestigious Joseph Schumpeter prize for innovative services in economy, economic sciences and politics .In 2006, he was awarded the Padma Bhushan. He was also named Businessman of the year by Forbes Asia. Time magazine listed him as one of the 100 most influential people in the world in 2006 & 2009. Foreign Policy magazine listed him as one of the Top 100 Global thinkers in 2010. In 2014, He won The Economist Social & Economic Innovation Award for his leadership of India’s Unique Identification initiative (Aadhaar). In 2017, he received the Lifetime Achievement Award from E & Y. CNBC- TV 18 conferred India Business leader award for outstanding contributor to the Indian Economy-2017 and he also received the 22nd Nikkei Asia Prize for Economic & Business Innovation 2017. He has been inducted as International Honorary Member of the American Academy of Arts and Sciences in 2019.Business Standard Annual awards 2022 conferred, “The Life Time Achievement Award”. TIME Magazine has featured him on 100 Most Influential People in AI- 2024.

Nandan Nilekani is the author of “Imagining India”, co- authored his second book with Viral Shah, “Rebooting India: Realizing a Billion Aspirations” and co-authored his third book with Tanuj Bhojwani, “ The Art of Bitfulness: Keeping calm in the digital world” released in Jan 2022. -

Oliver Bussmann

Chief Executive Officer

Bussmann Advisory

Oliver Bussmann

Chief Executive Officer

Oliver Bussmann is a globally recognized technology thought leader and driver of large-scale transformation at multi-national organizations and portfolio companies of private equity firms. The Founder and CEO of Bussmann Advisory AG, he advises enterprises and private equity companies looking to stay ahead of the digital disruption curve in the financial services and high-tech industry.

He is a Non-Executive Board Director at Bank of America Europe, Abu Dhabi Ports Group, Harvest Group, Board Chair at xSuite Group and Advisory Board Member at Actico Group and Modirum.

In addition, Oliver was Board Advisor at Elevandi (Global Finance Technology Network) and Co- founder and former President of the Swiss Crypto Valley Association which is the largest blockchain ecosystem with over 1’500 startups in Switzerland.

From 2013 to 2016 Bussmann was Group Chief Information Officer of UBS, where he successfully led a major Business and IT transformation effort, instituted a new group-wide innovation framework and established UBS as a pioneer in the development of blockchain for use in financial services. Prior to joining UBS Bussmann was Global Chief Information Officer at SAP, where he also spearheaded significant technology transformation and integration of company acquisitions, and before that CIO for North America & Mexico at Allianz. Previous roles have included executive positions at Deutsche Bank and IBM.

Bussmann's achievements and thought leadership have been widely recognized. He was named COO/CTO of the year by Financial News/The Wall Street Journal, European CIO of the Year by INSEAD/CIONET, Top FinTech Influencer to follow by Onalytica, Swiss FinTech Award, received the Elite 8 Award, which is given to the most innovative leaders in technology working in capital markets by Wall Street & Technology Magazine, and has twice been included on the Financial News "FinTech 40" list of innovators shaping the future of finance. -

Dr. Paul Taylor

Founder & Chief Executive Officer

Thought Machine

Dr. Paul Taylor

Founder & Chief Executive Officer

Paul Taylor is the founder and CEO of Thought Machine, the leading cloud-native core banking and payments technology provider. Thought Machine is present in 30 countries with a client list of more than 60 banks, including 16 Tier 1 banks.

Thought Machine is eradicating the outdated legacy technology prevalent in the banking industry. Its next-generation core platform enables banks to migrate away from old systems and launch highly differentiated, modern propositions.

Before founding Thought Machine, Paul successfully launched two companies, the second of which was acquired by Google in 2010. At Google, he led the text-to-speech team, which developed cutting-edge technology now used across Google's navigation and voice search products. Paul holds a PhD in AI and has held teaching positions at the University of Edinburgh and the University of Cambridge. -

Peter Kerstens

Advisor, DG FISMA

European Commission

Peter Kerstens

Advisor, DG FISMA

Peter advises on Technological Innovation, Digital Transformation and Cybersecurity at the European Commission’s financial services department. He has lead work on the European Commission’s Fintech Action Plan and Digital Finance Strategy and co-chaired the European Commission’s Fintech Taskforce. Peter is often referred to as the architect of Mica (the EU Markets in Crypto Assets Regulation) and Dora (the EU Digital Operational Resilience Act).

Peter has extensive experience in EU policy and regulation in a wide variety of fields, including single market, financial services, digitalisation, security, foreign policy sanctions, consumer protection as well as health and food safety. Earlier in his career, Peter was Finance Counsellor at the EU Embassy in Washington DC. He has also been a member of the private offices of the commissioner for the internal market and services and the commissioner for health and consumer protection. Before joining the European Commission, Peter advised major corporations on EU policy and regulatory affairs.

He is a Dutch national and holds double magna cum laude master degrees in European affairs and political science from the College of Europe in Bruges and the University of Leuven, Belgium. He is an Adjunct Professor of Law at Vanderbilt University Law School and a consummate public speaker. -

Ravi Menon

Chairman of the Board of Directors, Global Finance & Technology Network (GFTN); Ambassador (Climate Action), Singapore & Former Managing Director, Monetary Authority of Singapore

Global Finance & Technology Network (GFTN)

Ravi Menon

Chairman of the Board of Directors, Global Finance & Technology Network (GFTN); Ambassador (Climate Action), Singapore & Former Managing Director, Monetary Authority of Singapore

Mr Ravi Menon has a portfolio of work in sustainability, innovation, and inclusion.

Mr Menon is Singapore’s first Ambassador for Climate Action and Senior Adviser to the National Climate Change Secretariat at the Prime Minister’s Office. He plays a leading role in Singapore’s efforts to foster collective action internationally and transition planning locally towards a low-carbon future. He is also Chairman of the Glasgow Financial Alliance for Net Zero (GFANZ) Asia-Pacific Advisory Board and a member of the GFANZ Principals Group.

Mr Menon is Chairman of the Global Finance & Technology Network, which harnesses technology and fosters innovation for more efficient, resilient, and inclusive financial ecosystems globally. He is also a Trustee of the National University of Singapore (NUS) and Chairman of its Innovation and Enterprise Committee.

Mr Menon is Chairman of ImpactSG, a philanthropy which aims to grow a community of purposeful givers in Singapore and Asia. He is also a Board Member of The Majurity Trust, a charity which deploys cause-based funds for social needs; and a Trustee of the Singapore Indian Development Association, a community self-help group.

Prior to his current roles, Mr Menon served for 36 years in the Singapore Public Service.

As Managing Director of the Monetary Authority of Singapore (2011-23), Mr Menon oversaw monetary and macroprudential policies, reformed the financial regulatory framework, and developed Singapore as a green finance centre and a global FinTech hub. On the international front, he served as Chairman of the Network of Central Banks and Supervisors for Greening the Financial System and Chairman of the Financial Stability Board Standing Committee on Standards Implementation.

As Permanent Secretary at the Ministry of Trade & Industry (2007-11), Mr Menon helped to steer the economy during the global financial crisis. As Deputy Secretary at the Ministry of Finance (2003-07), he oversaw fiscal policy and government reserves.

Mr Menon is a recipient of the Meritorious Service Medal from the Singapore Government, the Distinguished Alumni Award from NUS, and the Distinguished Leadership and Service Award from the Institute of International Finance in Washington.

Mr Menon holds a Master's in Public Administration from Harvard University and a Bachelor of Social Science (Honours) in Economics from NUS. -

Ray Harishankar

IBM Fellow & Vice President

IBM

Ray Harishankar

IBM Fellow & Vice President

Ray Harishankar is an IBM Fellow in IBM Research focused on Quantum Safe. Ray is responsible for driving the overall strategy for IBM Quantum Safe, quantum safe products and product engineering. Ray leverages the deep technical expertise of IBM in security services, post quantum cryptography and pragmatically applies it at clients. He advocates IBM capabilities and leadership in Quantum Safe with clients.

Ray engages with customers across Insurance, Banking, Tele-Communications and Government and is on the technology advisory council for selected clients and universities.

Ray was nominated as an IBM Fellow in ’06, named an Asian American Engineer of the Year, a Distinguished Alumnus by the OSU College of Engineering and included in Marquis Who’s Who. He holds 25 patents. -

Richard Teng

Chief Executive Officer

Binance

Richard Teng

Chief Executive Officer

Richard Teng is an experienced executive with over three decades of financial services and regulatory experience. Richard has been the CEO of Binance since his appointment in November 2023. By working closely with various stakeholders including regulators, policymakers, industry players and users, Richard is furthering the growth of Binance in a compliant and sustainable manner. Prior to this role, Richard held various senior leadership roles within the company since joining in August 2021.

Before joining Binance, Richard was CEO of the Financial Services Regulatory Authority at Abu Dhabi Global Market (ADGM), where he showcased his capabilities as one of the world’s foremost innovative regulators. Richard’s vast experience also includes being the Chief Regulatory Officer of the Singapore Exchange (SGX) and the Director of Corporate Finance in the Monetary Authority of Singapore.

Richard received his Masters in Applied Finance from the University of Western Australia. -

Richard Verma

Chief Administrative Officer

Mastercard

Richard Verma

Chief Administrative Officer

Rich Verma is Chief Administrative Officer for Mastercard, overseeing the company’s Law, Government Affairs and Policy, Franchise, Corporate Security, Community & Belonging and Global Entity Governance functions. He is a member of the company’s Executive Leadership Team and Management Committee.

Rich has a distinguished background as a public servant. He was deputy secretary of state for management and resources from 2023 to 2025, acting as chief operating officer for the State Department. He was also previously the U.S. ambassador to India and led one of the largest U.S. diplomatic missions championing historic progress in bilateral ties.

Rich also has extensive experience in the private sector. Prior to his State Department tenure, Rich was chief legal officer and head of global public policy at Mastercard. He is a former partner at Steptoe & Johnson and vice chairman of The Asia Group.

He is a U.S. Air Force veteran and the recipient of numerous military and civilian decorations. Rich is a board member of the Ford Foundation and the inaugural President’s Distinguished Fellow at Lehigh, where he earned his Bachelor of Science. Rich also holds post-graduate degrees from American University and Georgetown University, including a PhD in International Relations from Georgetown. -

Dr. Roy Fielding

Senior Principal Scientist

Adobe

Dr. Roy Fielding

Senior Principal Scientist

Roy T. Fielding, Senior Principal Scientist at Adobe, is known for his pioneering work on the World Wide Web, open source, and software architecture. He is a founder and former chairman of The Apache Software Foundation, author of the Apache License 2.0, and editor of the IETF standards for HTTP, URI, and URI Templates. Dr. Fielding defined the REST architectural style in his Ph.D. dissertation in Information and Computer Science at the University of California, Irvine.

-

Tan Su Shan

Chief Executive Officer

DBS Bank

Tan Su Shan

Chief Executive Officer

Ms Tan Su Shan is the CEO and Director of DBS Group. DBS is the largest bank in Southeast Asia.

Su Shan was previously the Deputy CEO and Group Head of Institutional Banking, and before that, Group Head of Consumer Banking and Wealth Management for close to a decade. She was also the President Commissioner for PT Bank DBS Indonesia from 2014 to 2024.

Su Shan has over 35 years of experience in consumer banking, wealth management and institutional banking. Besides Singapore, she has experience in major financial centres such as Hong Kong, Tokyo and London. Before joining DBS, Su Shan was Morgan Stanley’s Head of Private Wealth Management for Southeast Asia. She has also worked at Citibank and prior to that at ING Barings.

She served as a Nominated Member of Parliament in Singapore from 2012 to 2014. In August 2025, Su Shan was also appointed by the Singapore Government to the Economic Strategic Review Committee on Global Competitiveness which seeks to strengthen Singapore’s economic standing and relevance to the world.

In 2025, Su Shan ranked 6th globally in Fortune’s Most Powerful Women in Business List, making her the only Singaporean to feature in the Top 10. In 2024, she was also featured on Forbes Asia’s Power Businesswomen List.

In 2019, The Asset named Su Shan as one of the six women in Asia who are likely to influence and feature prominently in shaping the banking and associated financial services industry in Asia.

In 2018, she was nominated by Forbes Magazine as a “Top 25 Emergent Asian Woman Business Leader”. In the same year, she was also named “Retail Banker of the Year”, by the Digital Banker in their inaugural Global Retail Banking Innovation Awards. She was awarded the “Lifetime Achievement” award at the WealthBriefingAsia 2018 Awards.

In October 2014, Su Shan became the first Singaporean to be recognised as the world’s “Best Leader in Private Banking” by PWM/The Banker, a wealth publication by the Financial Times Group.

Su Shan sits on the advisory board of Dyson’s family office, Weybourne Holdings, as well as on the boards of the Singapore Economic Development Board and Climate Impact X Pte Ltd. She was previously on the board of the Central Provident Fund of Singapore (CPF Board), MPACT Management Ltd. (the Manager of Mapletree Pan Asia Commercial Trust), EvolutionX Debt Capital Pte. Ltd. (a fund focused on growth debt, founded jointly by Temasek and DBS), and The Singhealth Fund Limited, which provides financial support to needy patients.

Married with two children, Su Shan is actively involved in fund-raising efforts for various Singapore charities. She is a member of the International Women’s Foundation and the Young Presidents Organisation, as well as an advisor to Oxford University's Lincoln College. She is also the Founder President of the Financial Women’s Association in Singapore, a non-profit organisation she founded and pioneered in 2001 to help develop and mentor women in the financial industry.

Su Shan graduated with a Master of Arts from Lincoln College, Oxford University where she studied Politics, Philosophy and Economics. She has also completed executive leadership courses in Harvard Business School, Stanford Business School, and Singularity University. -

Vijay Shekhar Sharma

Founder & Chief Executive Officer

Paytm

Vijay Shekhar Sharma

Founder & Chief Executive Officer

Vijay Shekhar Sharma, Chairman, MD, and CEO of One97 Communications

Vijay Shekhar Sharma is the founder of Paytm and an Indian technology innovator who has transformed the mobile payments and financial services distribution landscape in the country. He led India’s shift towards a mobile-first economy and pioneered innovations such as QR code-based payments, Soundbox, and card machines—redefining the way Indians transact.

A firm believer in the power of emerging technologies, Vijay has been at the forefront of India's Artificial Intelligence revolution, driving advancements that enhance financial inclusion, strengthen digital infrastructure, and drive innovation in the payments ecosystem.

He is also a prolific investor, supporting startups across fintech, e-commerce, and technology, shaping the future of India’s tech landscape and reinforcing the country’s position as a global leader in digital advancements. -

Wee Ee Cheong

Deputy Chairman & Chief Executive Officer

UOB

Wee Ee Cheong

Deputy Chairman & Chief Executive Officer

Mr Wee was appointed to the Board on 3 January 1990 and last re-elected as a Director on 21 April 2023. He is a member of the Board Risk Management Committee, Executive Committee and Nominating Committee.

A career banker with more than 40 years’ experience, Mr Wee joined UOB in 1979 and was appointed as its Deputy Chairman on 24 March 2000. On 27 April 2007, he assumed the position of Chief Executive Officer. He also sits on the boards of several UOB subsidiaries including United Overseas Insurance (Chairman), PT Bank UOB Indonesia (President Commissioner), United Overseas Bank (China) (Chairman), United Overseas Bank (Thai) Public Company (Chairman) and United Overseas Bank (Malaysia) (Deputy Chairman). He was also formerly a director of Far Eastern Bank.

Active in industry and community development, Mr Wee is a council member of The Association of Banks in Singapore and The Institute of Banking and Finance. He is also a member of the Board of Governors of the Singapore-China Foundation and an Honorary Council Member of the Singapore Chinese Chamber of Commerce and Industry. He was previously Deputy Chairman of the Housing and Development Board and a director of the Port of Singapore Authority, Pan Pacific Hotels Group, UOL Group and United International Securities, and a member of the Visa AP Senior Client Council.

A keen art enthusiast, Mr Wee is the Patron of the Nanyang Academy of Fine Arts. He is also a director of Wee Foundation.

Mr Wee holds a Bachelor of Science (Business Administration) and a Master of Arts (Applied Economics) from American University, Washington, DC.

In 2013, he was awarded the Public Service Star for his contributions to the financial industry.

In 2024, Mr Wee was conferred the Investors’ Choice Outstanding CEO Award by Securities Investors Association (Singapore). Mr Wee was also conferred with The Asian Banker CEO Leadership Achievement for Singapore Award and named the Best CEO (large cap listed companies) by the Singapore Institute of Directors for his outstanding leadership. He was awarded The Business Times Businessman of the Year 2021/2022. -

Yang Peng

Chief Executive Officer

Ant International

Yang Peng

Chief Executive Officer

As Chief Executive Officer, Mr. Yang leads Ant International’s efforts in delivering a full stack of innovative digital payment, financial technology and digitalization solutions to global merchants. He also acts as the President of the Greater China Payment and Embedded Finance businesses, which provide cross-border mobile payment and digital marketing solutions for Chinese users travelling worldwide. Additionally, Mr. Yang manages Ant International’s Hong Kong and Macao operations.

Prior to serving at Ant International, Mr. Yang held various key management positions at Alipay, under Ant Group. Before joining Ant Group, he served as the Global Vice President of Dell Technologies, holding various executive roles in product development, strategy and business development across Greater China, Asia Pacific, and global emerging markets, accumulating extensive experience in cross-market and cross-cultural management.

Mr. Yang holds a B.A. degree in International Business and Finance from the Lingnan College of the Sun Yat-sen University, and an MBA degree from the Carlson School of Business at the University of Minnesota.

Grab your early bird pass at only SGD 750

Asia’s largest FinTech meetings programme.

2025 Festival Overview

Insights Forum*

Sands Expo & Convention Centre

The invitation-only Insights Forum, held under Chatham House rules and designed to facilitate actionable outcomes through meaningful dialogue, will be run over two days prior to the Singapore FinTech Festival in 2025.

The Forum is a platform for:

- Shaping policy, technology and financial services roadmaps to guide industry direction

- Framing greenfield topics with candid discussions amongst key public-private stakeholders to foster innovative solutions and consensus

- Driving learning through expert insights and deep, actionable knowledge that empowers informed decision-making

Tuesday 11th November

- Regulators' Breakfast Briefings

- Executive Leaders Breakfast Session

Held throughout the year across Elevandi’s global initiatives, these long-form roundtable discussions are held under Chatham House rules, fostering open and in-depth public-private sector leadership dialogues and promoting tangible results.

Steered by a regulator or policymaker, each roundtable is purposefully tailored to drive actionable outcomes, from whitepapers to the initiation of a working group or the declaration of a new commitment.

Launch: Women Regulators Network

Held throughout the year across Elevandi’s global initiatives, these long-form roundtable discussions are held under Chatham House rules, fostering open and in-depth public-private sector leadership dialogues and promoting tangible results.

Steered by a regulator or policymaker, each roundtable is purposefully tailored to drive actionable outcomes, from whitepapers to the initiation of a working group or the declaration of a new commitment.

Full Day

- Public-Private Roundtables

- Deep Dive Workshops

- Closed-Door Boardrooms

Held throughout the year across GFTN’s global initiatives, these long-form roundtable discussions are held under Chatham House rules, fostering open and in-depth public-private sector leadership dialogues and promoting tangible results.

Steered by a regulator or policymaker, each roundtable is purposefully tailored to drive actionable outcomes, from whitepapers to the initiation of a working group or the declaration of a new commitment.

Tuesday 11th November

Full-Day Co-Located Event

MUFG FinTech Festival

Summit Stage

Network with central bankers, regulators, policymakers, industry leaders, technologists, and investors at the daily networking reception, open to all Forum attendees!

Spotlight

Japan in the Spotlight

Launchpad Room

Network with central bankers, regulators, policymakers, industry leaders, technologists, and investors at the daily networking reception, open to all Forum attendees!

Full Day Co-located Event

AIFC Connect: Singapore 2025

Summit Stage

Spotlight

Malaysia Fintech in the Spotlight

Launchpad Room

Spotlight

Institutional Digital Assets in the Spotlight

Launchpad Room

Networking Receptions

Take a tour of the most cutting-edge FinTech innovation labs in Singapore. The Innovation Lab Crawl will give attendees the opportunity to step inside the innovation labs and witness the latest up-and-coming projects and innovations in the FinTech industry.

Tuesday 11th November

SFF Innovation Lab Crawl

Take a tour of the most cutting-edge FinTech innovation labs in Singapore. The Innovation Lab Crawl will give attendees the opportunity to step inside the innovation labs and witness the latest up-and-coming projects and innovations in the FinTech industry.

Tuesday 11th November

.jpg)

Singapore FinTech Festival 2025

Hall 1 - 6, Singapore Expo

The Singapore FinTech Festival is a global nexus where policy, finance, and technology communities converge. Designed to foster impactful connections and collaborations, SFF is a platform to explore the intersections of cutting-edge financial solutions, evolving regulatory landscapes, and the latest technological innovations.

Friday 14th November

Across 5 halls

Exhibition

Explore the forefront of financial innovation at the Singapore FinTech Festival's exhibition. With over 600 exhibitors and 41 international pavilions, discover cutting-edge solutions and emerging technologies redefining the financial landscape – free to access with a Trade Visitor pass.

Friday 14th November

Festival Stage

The Festival Stage features macro perspectives on the state of policy and other developments, as well as progress on key fronts. Over three days, global leaders, policymakers, and innovators will share their insights on finance, technology, sustainability, and related fields, providing a comprehensive perspective on the forces shaping the global economy.

Friday 14th November

Founders Stage

The Founders Peak Stage brings TED-inspired sessions that celebrate the spirit of entrepreneurship in fintech. Hear founders from around the world share their personal journeys, hard-earned lessons, and practical wisdom with investors and the wider fintech community. Expect inspiring stories, fresh perspectives, and insights to boost startup success and empower the next generation of innovators.

Friday 14th November

Catalyst Stage

The Catalyst Stage is where the future of fintech talent takes centre stage. Expect dynamic pitches from young visionaries, thought-provoking debates on AI, and presentations from global associations. Beyond innovation, the Catalyst Stage also tackles the human side of finance — careers, well-being, and education. Stories of upskilling and emerging economies powering growth offer inspiration for how talent will shape the industry’s future.

Friday 14th November

Impact Stage

The Impact Stage explores new tech and policy developments shaping finance. Sessions cover digital assets, AI, tokenization, and global partnerships, while also spotlighting sustainability and regional innovation. Expect discussions on advancing solutions, financial literacy, and how emerging technologies are reshaping the sector, with highlights from initiatives across the globe.

Friday 14th November

FutureMatters Stage

The FutureMatters Stage explores how technological disruptions are reshaping the financial landscape. Sessions will highlight emerging business models driven by digital assets, financial inclusion in a rapidly changing environment, and the infrastructures enabling the future of fintech. Discussions will also cover strategic implications of new technologies, evolving global regulations, and C-suite perspectives on industry transformation. Looking ahead, the FutureMatters Stage will host conversations on AI regulation, the future of work, the role of education, and strategies for building a sustainable financial ecosystem.

Friday 14th November

Frontier Stage

The Frontier Stage delves into the advanced technologies that drive innovation across finance and fintech. From AI, cloud, and digital banking transformations to operational priorities shaping the future of financial services, this stage spotlights the technologies redefining industry standards. Sessions will examine next-generation finance, including cyber resilience, national digital currencies, DeFi and TradFi integration, and breakthroughs in InsurTech. In addition, the programme will explore how advanced technologies ensure security and inclusion, with forward-looking insights on digital transactions, data protection, and quantum advances in financial services.

Friday 14th November

Investor Hours

Investor Hours is designed to empower both investors and startups throughout their investment and fundraising journeys. This programme brings together investors and startups from around the world, creating opportunities for fundraising, investment, collaboration, and market expansion.

Friday 14th November

.jpg)

SFF MeetUp

SFF MeetUp is an initiative designed to help attendees meet, collaborate, and conduct business efficiently, fostering new partnerships and driving growth opportunities for both individuals and organisations. Don’t miss this opportunity to get six months' worth of one-on-one meetings in just two days!

Thursday 13th November

Global FinTech Hackcelerator

Returning this November at the Singapore FinTech Festival, the Global FinTech Hackcelerator 2025 spotlights early-stage innovators transforming financial services. Up to 20 startups will be selected as finalists to receive mentorship, network with investors, and pitch at Demo Day on 12 November for a SGD 240,000 prize pool and opportunities to pilot their solutions with industry leaders.

SFF Dinner*

We bring together the Festival's guests and VIPs for an evening of networking and collaboration at one of Singapore's iconic locations.

SFF After Hours

SFF After Hours offers a relaxed, evening setting for networking and collaboration. Attendees can connect with industry peers, thought leaders, and innovators through engaging activities, social events, and informal discussions. This blend of professional and social interactions helps spark new ideas, strengthen relationships, and drive the future of FinTech.

Open to all Executive, Delegate, Startup, Government, Academic, VIP, Speaker, and Media Passes.

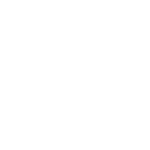

SFF FinTech Excellence Awards*

The Monetary Authority of Singapore (MAS) and the Singapore FinTech Association (SFA), supported by PwC Singapore, invite nominations for the 2025 SFF FinTech Excellence Awards. Now in their 10th year, the Awards celebrate innovative initiatives and individuals driving growth, financial inclusion, and transformative solutions in FinTech.

SFF Wrap Party ft. The Founders Rock

*By invite-only

Be an Exhibitor: Grow Your Business Where Finance Evolves

Meet 70,000+ decision-makers, buyers and innovators from 140+ countries and regions. SFF 2026 is where global finance meets real business and deals get done.

Be a Sponsor: Lead the Conversations Shaping Global Finance

Command global visibility and influence by engaging C-suite leaders, policymakers and investors on the world's largest FinTech stage.

Thank You To Our 2025 Sponsors

Grand

Sponsors

Platinum

Sponsors

Gold

Sponsors

Silver

Sponsors

.png?width=400&height=200&name=dtcpay%20(1).png)

Bronze

Sponsors

Friends of FinTech

Sponsors

Strategic Knowledge Partner

Sponsors

Official Car Sponsor

Sponsors

Why You Should Exhibit at SFF 2026

Technology Zone

The technology zone at SFF offers a comprehensive and immersive experience for attendees, providing a platform for in-depth explo- ration of the latest developments in technology, with a focus on Artificial Intelligence (AI), Web3

Technology Zone

The technology zone at SFF offers a comprehensive and immersive experience for attendees, providing a platform for in-depth explo- ration of the latest developments in technology, with a focus on Artificial Intelligence (AI), Web3

Join the community

The Festival

Get Involved

Global Platforms

.png?width=400&height=200&name=Amazon%20(1).png)

.png?width=400&height=200&name=Banking%20Circle%20(2).png)

.png?width=400&height=200&name=HSBC%20(3).png)

.png?width=400&height=200&name=Visa%20(1).png)

.png?width=400&height=200&name=Cleanverse%20(1).png)

.png?width=400&height=200&name=Dyna.Ai%20(1).png)

20241101_105001.png?width=400&height=200&name=icbc%20(400x200)20241101_105001.png)

.png?width=400&height=200&name=NPCI%20(3).png)

%20(1).png?width=400&height=200&name=Partners%20Logo%20(400%20x%20200%20px)%20(1).png)

.png?width=400&height=200&name=OCBC%20(1).png)

.png?width=400&height=200&name=Pismo%20(1).png)

.png?width=400&height=200&name=stripe%20(GOLD).png)

.png?width=400&height=200&name=tazapay%20(1).png)

.png?width=400&height=200&name=VEEFIN%20(NEW%20LOGO).png)

.png?width=400&height=200&name=Accenture%20(2).png)

.png?width=400&height=200&name=Carta%20(1).png)

.png?width=400&height=200&name=cobo%20(4).png)